Oxford Street Reinvented

Ben recently took to Oxford Street to ask the question "can it make sense to have 4 stores in the same vicinity, no matter how strong that Retail Place is?"

14th August 2024 • GeoData

Two important disclosures at the outset: 1) I don’t like shopping and 2) Geolytix don’t currently work with Uniqlo (but if you’re reading, we’d love to…)

The reason I mention #1 is that whilst I’m often in and around shops for work, it’s quite rare to just have a wander (which is what I did yesterday – prompted by a summer holiday ‘I’m bored’ moment from the youngest Purple and a visit to the Apple Store on Regent St to try on the amazing Vision Pro goggles – if you’re at a loose end and don’t mind heights, I’d highly recommend it).

But when you have a wander, you see obvious things that you maybe miss when you’re on a more specific mission. For me, yesterday, it was just how much the Oxford Street retail scene has changed.

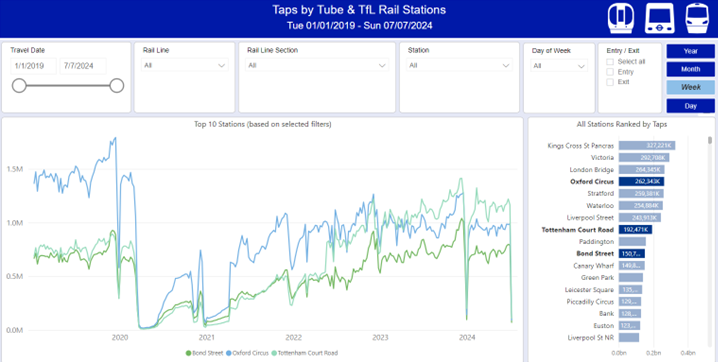

Looking at the TFL station data from their fabulous open dashboard, the total taps across Oxford Circus, Tottenham Court Road and Bond Street stations are pretty much the same as they were in June 2019 – within half a percent of each other w/c 16 June, in fact.

But that headline masks a massive shift between stations – back in 2019, Oxford Circus accounted for 50% of the taps, TCR 26%, and Bond St 24%. Fast forward 5 years and the Elizabeth Line, and TCR now leads the way with 40% of taps, Oxford Circus down at 34%, and Bond St pretty steady at 26%.

The difference that shift has had on the retail gravity and composition has been significant. In the years since covid and as the Elizabeth Line has got up and running, there was a short period where the doom-laden question was ‘why are there so many American Candy stores around Oxford Street’? On Sunday, the 2024 version of that question felt much more positive: ‘why are there are so many Uniqlo stores around Oxford Street’.

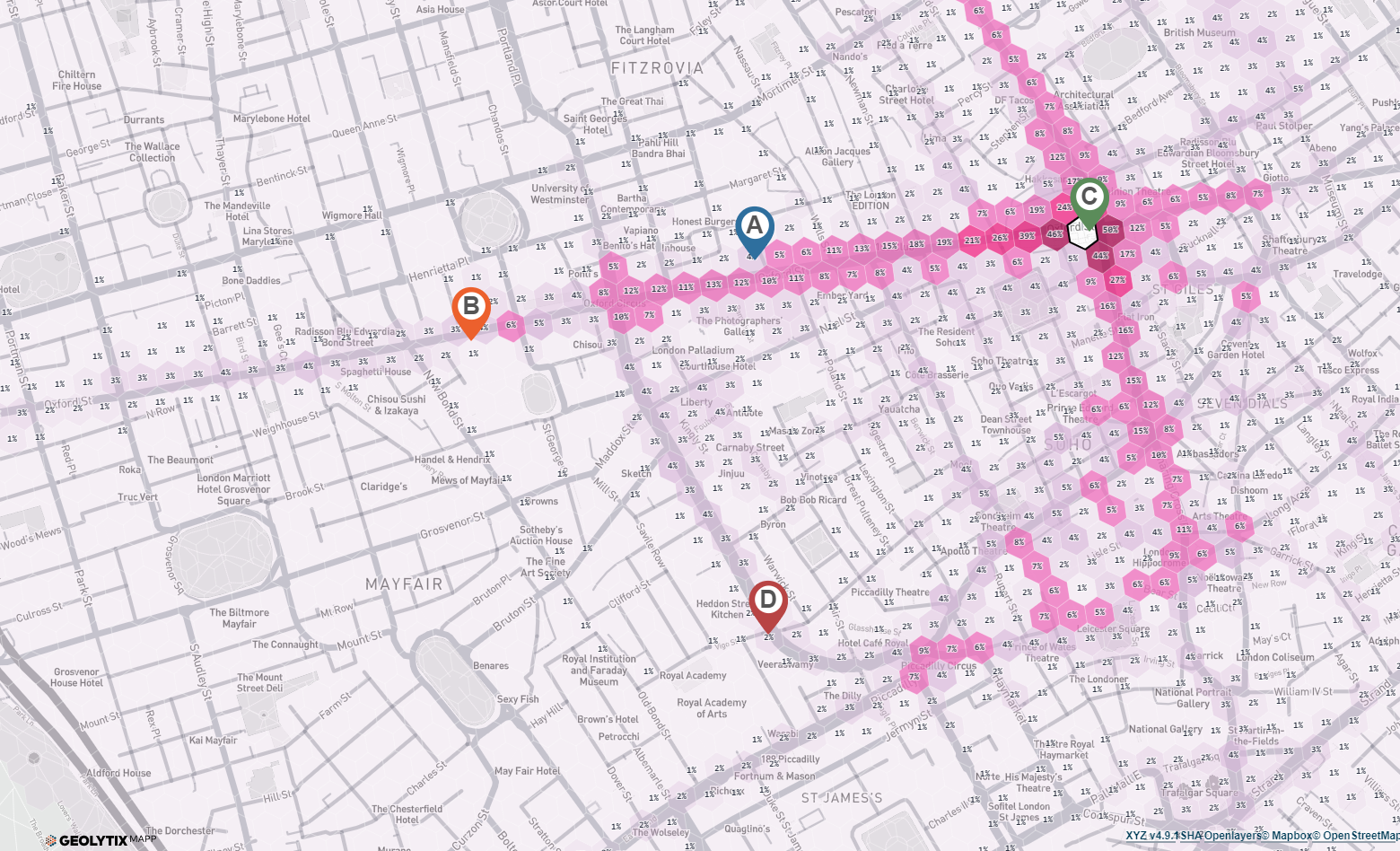

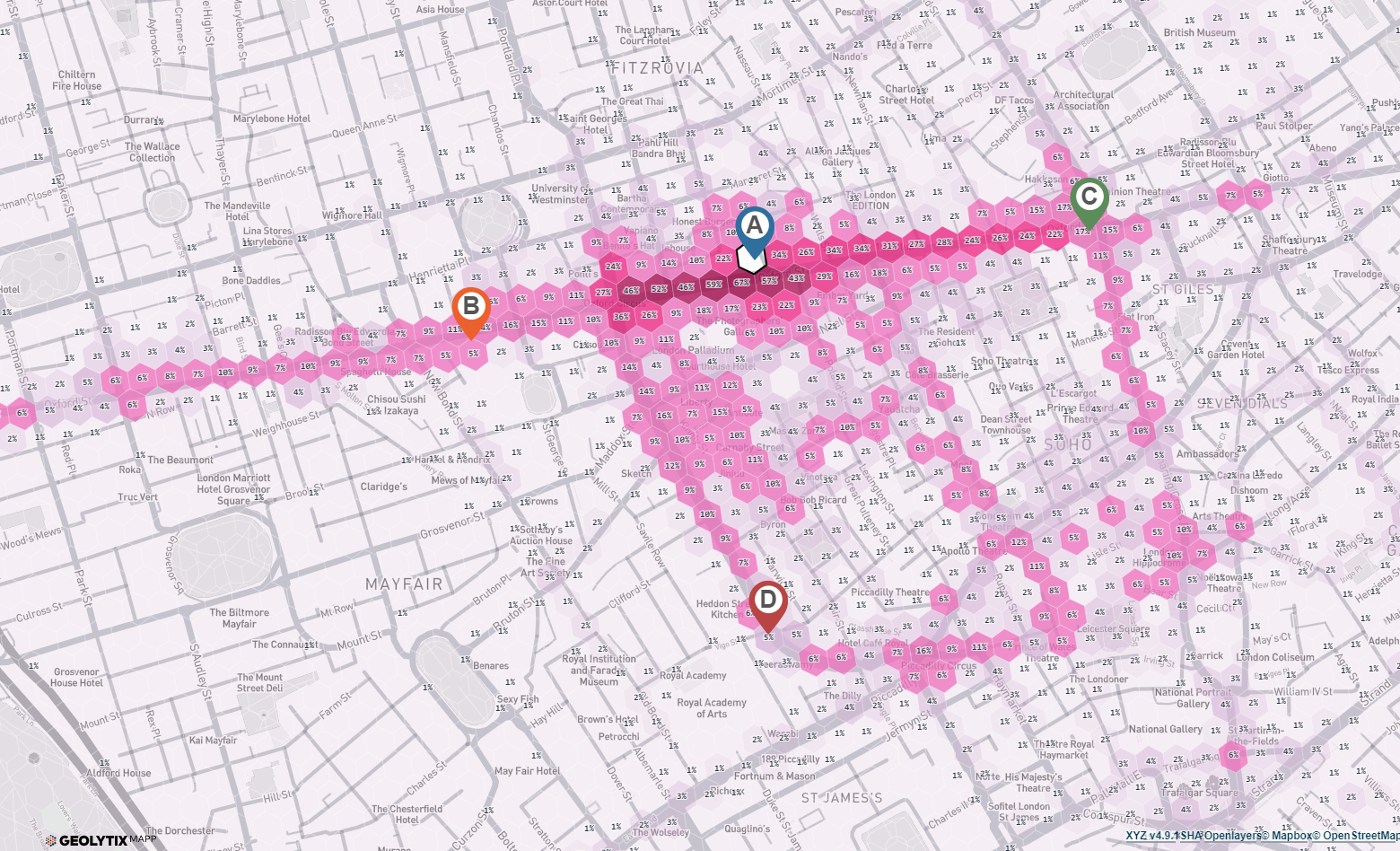

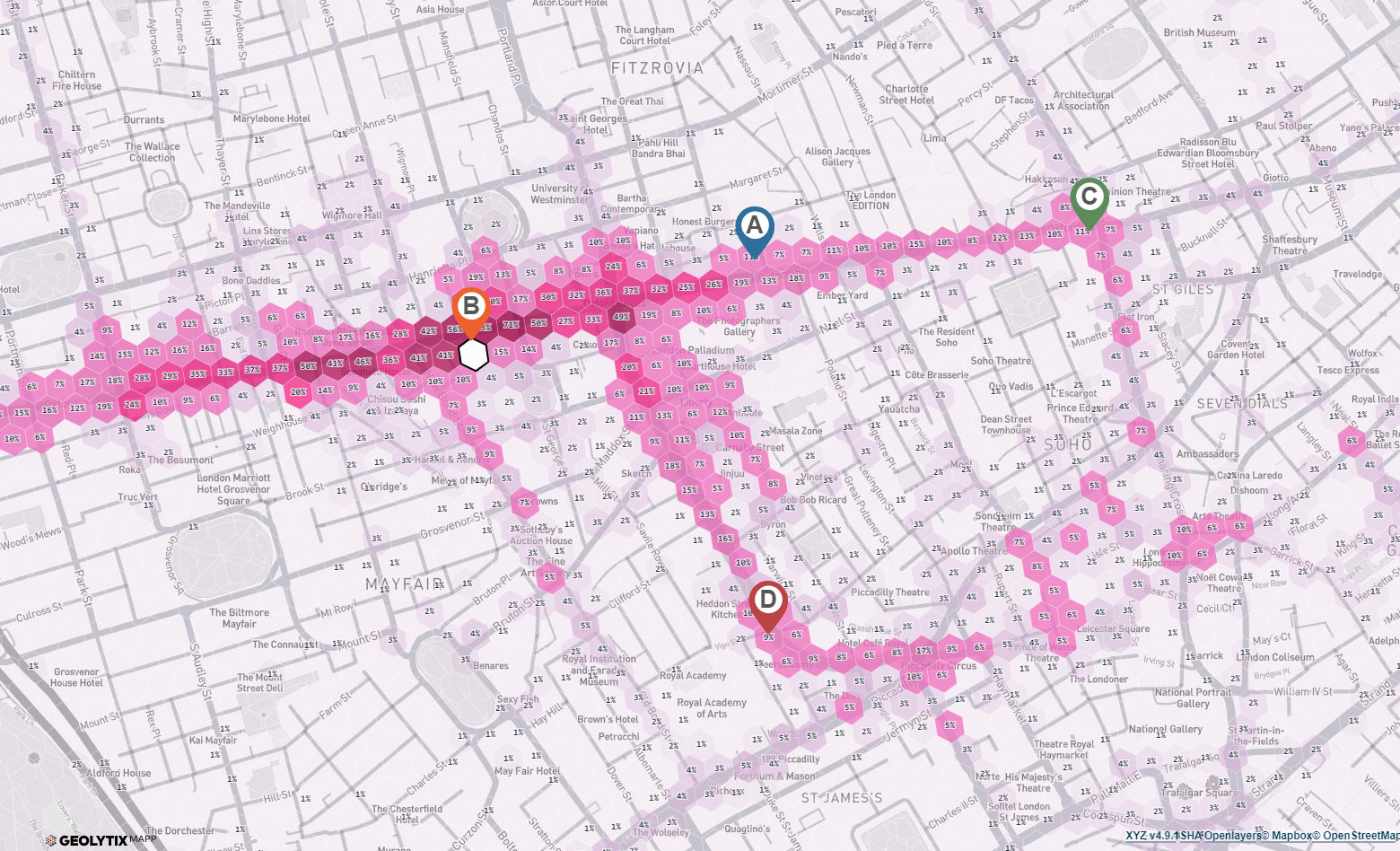

Which brings me to #2 and a quick Uniqlo case study / love letter after the opening of their latest store earlier this year as part of the One Oxford Street development, directly above Tottenham Court Road station. This store represents their 3rd store on Oxford Street, in addition to the one on Regent Street. The location planner in me immediately asked, can it make sense to have 4 stores in the same vicinity, no matter how strong that Retail Place is? And the answer is, it depends on how much overlap there is between those locations.

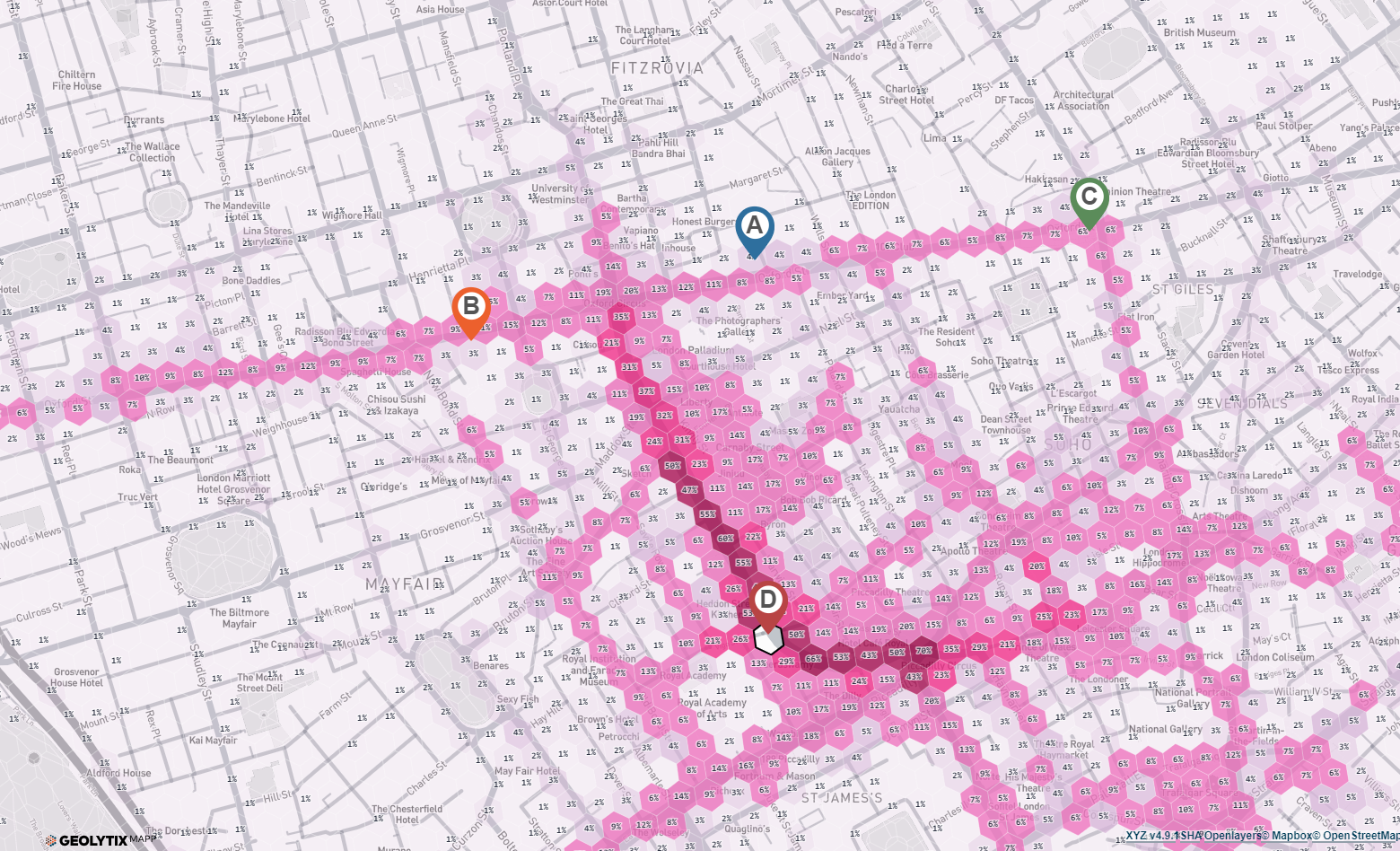

This gave me a good excuse to play with our Interaction Surfaces again – and we can see from the maps below that the 4 store strategy gives Uniqlo a really nice distribution with relatively low overlap between locations, despite their proximity to one another.

So, overall conclusions:

1) Oxford Street feels healthier and better balanced than it has for a long time;

2) Uniqlo have executed a great location strategy

3) If Uniqlo (or anyone else) wants to have a chat about Interaction Surfaces or anything else to help keep growing successfully, we’d love to talk… just drop me a note: ben.purple@geolytix.com

Photo by Jonathan Chng on Unsplash

Related Posts

-

Danish Design and Hygge Homeware - variety store trends in the UK

Josh reviews the grand opening of Søstrene Grene in Leeds along with other Danish brands taking the UK by storm. Who could be next?

Published 17th March 2025 • Tags market-visits

-

Debenhams: Two years (& two months on)

Over two years since the physical presence of Debenhams on our high streets ended, we review 126 units they left vacant. What’s become of them?

Published 2nd August 2023 • Tags market-visits, geodata

-

The Importance of Site Visits for Location Planners

While data driven insights are essential, site visits are indispensable for Location Planning. Alison interviewed our Location Planners to find out why we do them and 10 top tips that might help you next time.

Published 1st June 2023 • Tags market-visits, team-thoughts