Every retailer knows how important a catchment is for their store networks. Let me explain for those who are not familiar with the notion of catchment what it means – it is basically a micro market or a geographical area from which customers travel to a shop. Therefore, there are two important factors here - customers and geographical area. One needs to perfectly understood, both to identify the optimal locations for their retail outlets and to generate adequate future footfall. In established markets the key datasets help you to understand less of the “how many of them” (that’s kind of obvious) but much more of “what they are like”, so customer characteristics such as age – young vs mature, household structure – singles vs families, social profiles – affluent vs poor or early adapters vs followers etc. All those characteristics when combined could construct different types of catchments, requiring a variety of retail offers, different levels of consumption and ultimately a varied future turnover for potential retail investments.

Poland Demographic Background

In Poland and many other Eastern European countries although we see an increase in these demographic dilemmas, there is still a rather fundamental data issue to be fixed and it is still much more of “how many of them” than “what they are like”. The latter is of course also important but because of our history where everything and everybody was equal, hence spatial segmentation was almost non-existent – a CEO of a large company would live in the same house as a cashier or a teacher and they would all be sending their kids to the same schools and would shop in the same neighbourhood supermarket. This set up has been changing for the last 30 years but the bulk of population distribution is still heavily rooted in the past where everything was mixed. Therefore, debating whether Poznan’s Piątkowo is inhabited predominantly by young affluent families would be an exaggeration and a limited exercise. Those differences do exist, but they are on a smaller scale and matter more for niche businesses which rely on very micro catchments. The key challenge for bigger companies which plan their national expansion programmes across the region is whether they will be investing in growing or declining areas.

There are many ways to describe change in an area, but population dynamics would be the key one to understand whether you can expect your business to be generating higher or lower revenues and whether your like for like sales will grow or decline. In Poland, the statistical office or as we call it GUS is still the main source for population statistics. It keeps records of all the country’s inhabitants on various levels of geography (from county to community levels or from Województwo to Gmina as they are called in Polish). At Geolytix we also use new housing available at the detailed Gmina level, mobility data, POIs, economic activity and many other datasets which are indicators of change. For today however we will focus solely on population and new housing.

2021 Census

As in most countries, the census which is held every 10 years is the main source of demographic information. The last one which formed the base for all the national statistics over the last decade was held in 2011, however last year most of Europe (Poland included) held the latest iteration which is now being processed and slowly released to the general public.

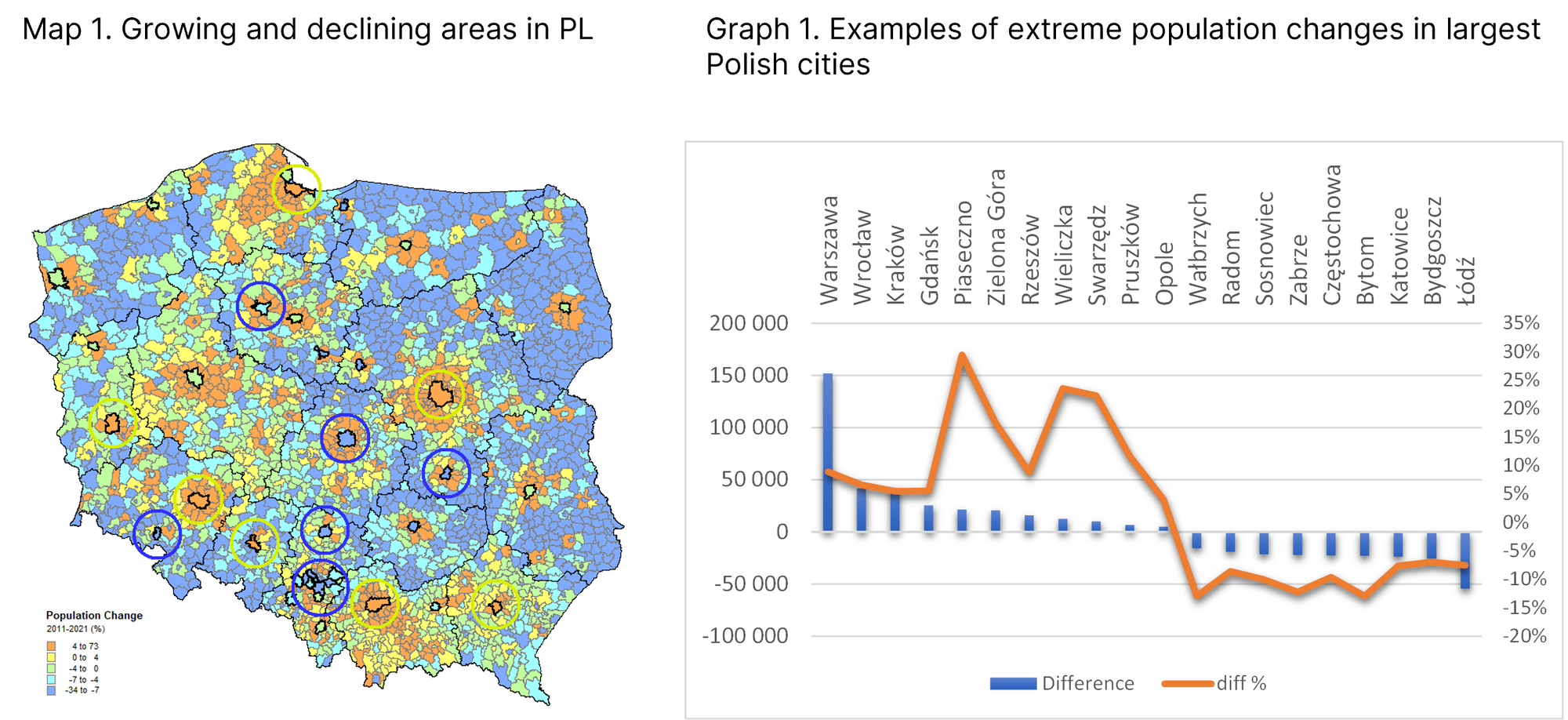

The key headline stat for many so far has been the decline in population by 476,000 people since 2011. As in many countries this level of change has been distributed very unevenly across the country. Firstly, we see a consistent trend of ruralisation (population of villages increased by 181,000) and constant decline in cities – the urban population has dropped by 654,000! Obviously, one needs to look at those numbers more carefully, interpreting an averaged national number can be misleading but can give us a general trend.

Declining Urban Population

So, what happened to the cities with a declining population? This has been a consequence of 3 main factors which are relevant not only to the cities themselves but to the overall national trend:

- Decreasing number of births

- Emigration to other countries

- Internal migration to the countryside and especially rural suburbs of large metropolitan areas

Most Polish cities have been impacted by this trend and combined have lost more than 600,000 people (a decline of 5-10% of their 2011 population). The key large cities affected by the negative growth include Łódź which lost over 50 thousand, Bydgoszcz, Częstochowa, Katowice, Bytom, Radom Sosonowiec and Zabrze from 20 to 25 thousand but there are tens of smaller ones which contribute to that high loss of population.

Top urban gainers

The largest cities such as Warsaw, Krakow, Wroclaw and Gdansk have however reversed the urban decline trend, and have indeed witnessed a boom in population within their urban administrative boundaries:

- Warsaw having gained over 150,000 (9%)

- Wroclaw 42,000 (7%)

- Krakow 40,000 (5%)

- Gdańsk 25,000 (6%)

In addition to these major markets there are some 10+ smaller settlements which form satellite towns within those large agglomerations with even higher double digit growth rates.

Elsewhere, administrative boundaries changes (another impact of the new census rollout), have resulted in growth for 3 smaller regional cities - Rzeszów, Opole and Zielona Gora.

Sub-Urban Growth

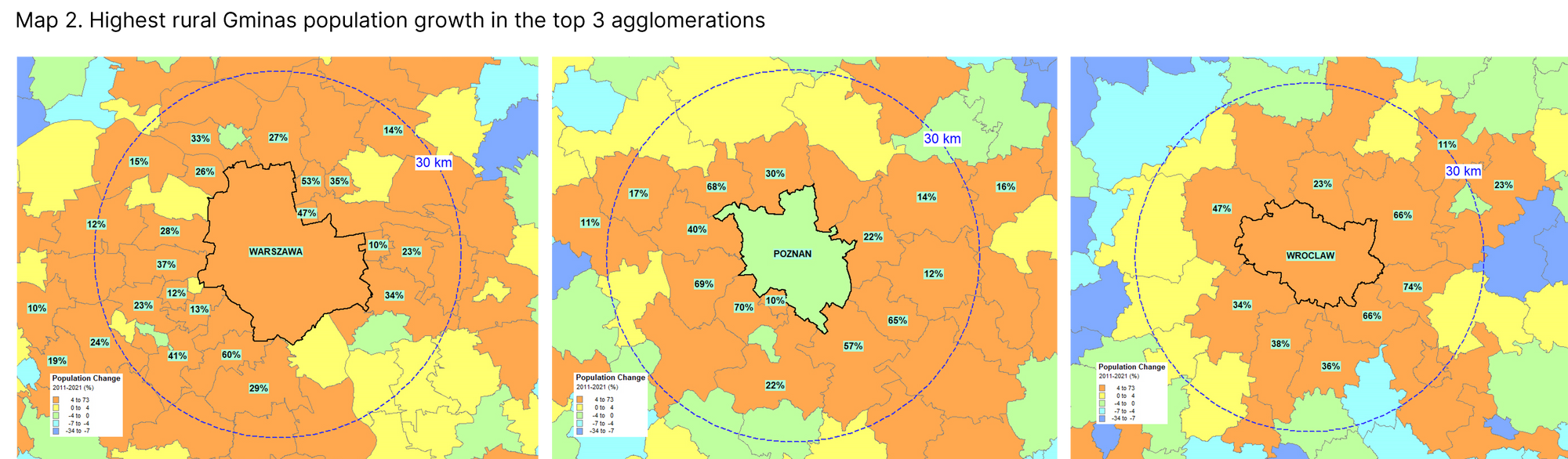

Now let’s have a look at the growing rural or sub-urban population. That positive delta is of course a bit misleading here too as the main contributors of that number are rural settlements around large cities which in fact make them more of suburban housing districts rather than typical rural areas as they are currently classified by the national statistics. There are only 3 cities in the whole country where rural surroundings hardly saw any population growth, these are Walbrzych, Opole and the Eastern part of the Katowice Conurbation. Otherwise, all other large cities have seen a net gain in their rural suburbs having grown by 450,000 people which accounted for 6% when compared to 2011 census.

In Warsaw, on top of the growth of 150 thousand within the urban admin boundaries, given the strength and pull of the agglomeration it additionally benefits from the highest number of rural newcomers with an additional 125,000 people within 50km - a daily commuting distance to the city centre. Poznan follows suit with a growth of almost 100,000 new inhabitants and Gdansk-Gdynia-Sopot being ranking third for growth with 65,000. Then there are Krakow and Wroclaw with around 50,000 each and the rest of the smaller cities falling into a one-digit category

Travelling around the country it’s been great to see first-hand some of the fastest growing settlements develop over the last 10 years:

- The Gmina of Kosakowo north of Gdynia which grew from 11 to 20,000

- Komorniki, Dopiewo and Rokietnica in Poznan area with c. 70%

- Długołęka and Siechnice in Wrocław with 65%

- Wieliszew, Lesznowola and Żabia Wola in Warsaw agglomeration with 40-60%

Rural Birth Rate

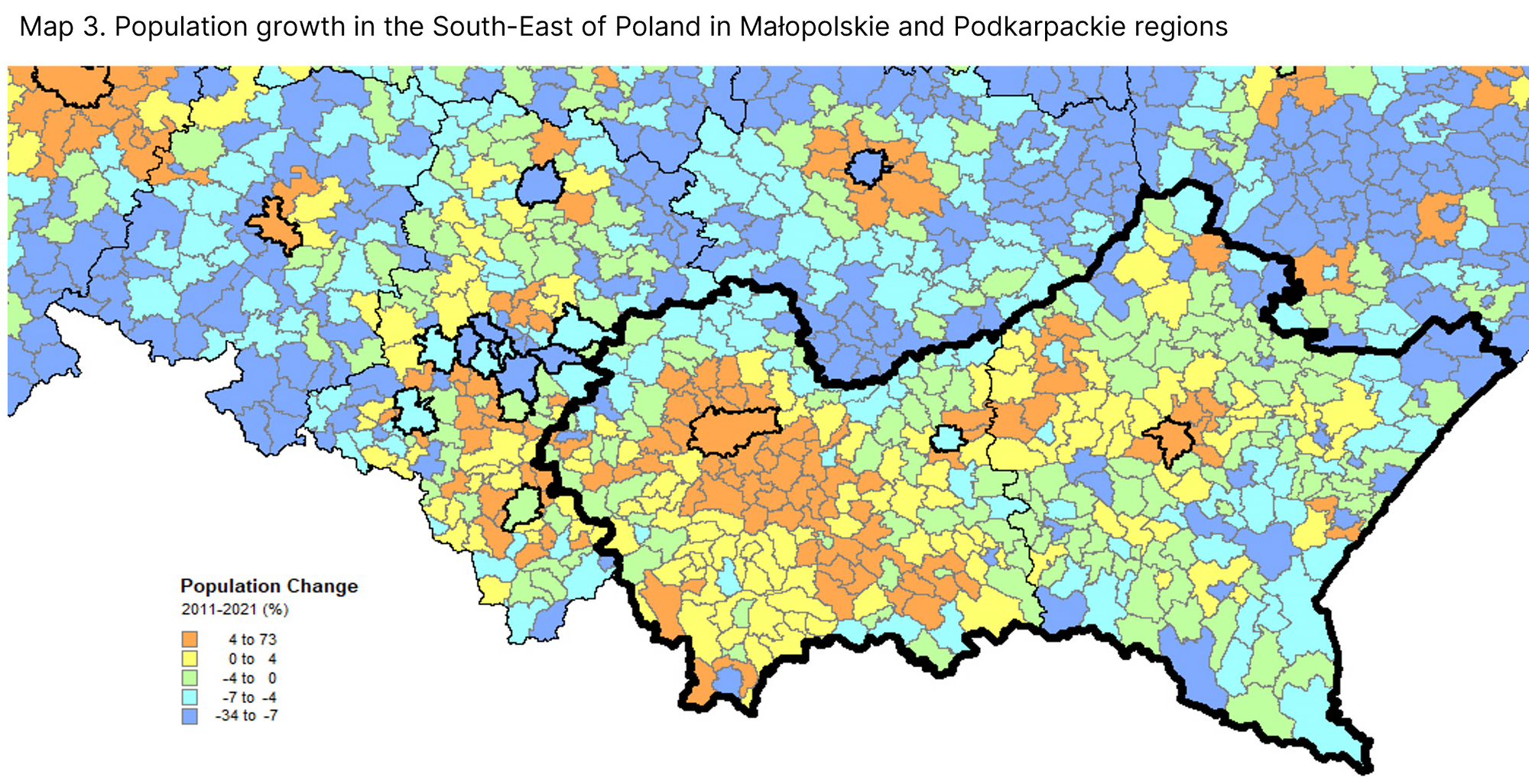

There is also one more regional pattern for the rural population growth on top of being part of a larger agglomeration, and that’s South-East Poland (Małopolska and most of Podkarpacie). This region still demonstrates way of life and values where population growth is not a result of wealth. It’s the way people live their lives there - they have growing families contributing to positive population growth, something which has been a norm for the last hundreds of years but has been slowly diminishing, still exists in south-east Poland having positive impact on retail market.

Population growth which is concentrated around the pockets of largest Polish cities and in South-East contribute 60% and 15% of all the growth in the entire country respectively.

Rural Decline

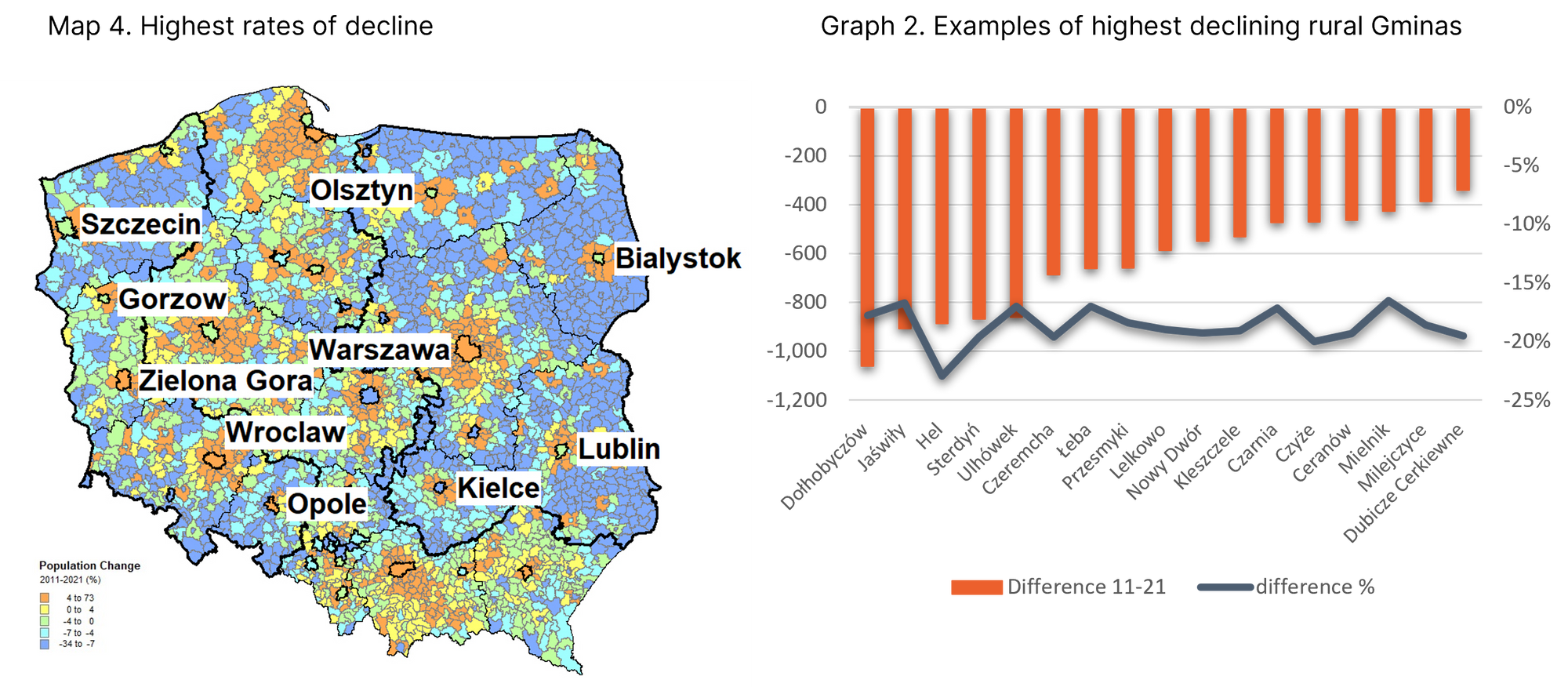

Not all Polish rural Gminas are growing and most of them have been declining – out of the 2,171 rural Gminas 1,679 witness a decline in population of between -1% to -20%. You can say that if the area is not a suburb of a larger city or is not in South-East Poland there is a high chance that it will be losing its population. The level of the decline is not consistent however and can be as high as double digit negative delta in the North-East around Bialystok. Over to the Eastern and Western fringes of the country the decline is around -5% to -10%.

This article of course covers macro level changes, over the coming weeks and months we will be working closely with our clients in Poland and elsewhere across Eastern Europe to understand how the micro level changes will continue to shape their retail networks, whether that be in Gocław or Służew in Warsaw, Ruczaj in Kraków or Klecina in Wroclaw. Understanding how areas have changed in the last decade combined with new datasets on movement are also helping us form our understanding of potential demographic shifts and their impacts in the coming years.

Jacek Biel, Director, Central Europe at GEOLYTIX

Main Image: Photo by Sebastian Huber on Unsplash